Introduction

Financial growth represents the increase in your wealth over time.

It plays a critical role in both personal and professional life.

Achieving financial stability allows individuals to enjoy a better quality of life.

Moreover, it provides businesses with the capital needed to expand and innovate.

Thus, understanding financial growth is essential for everyone.

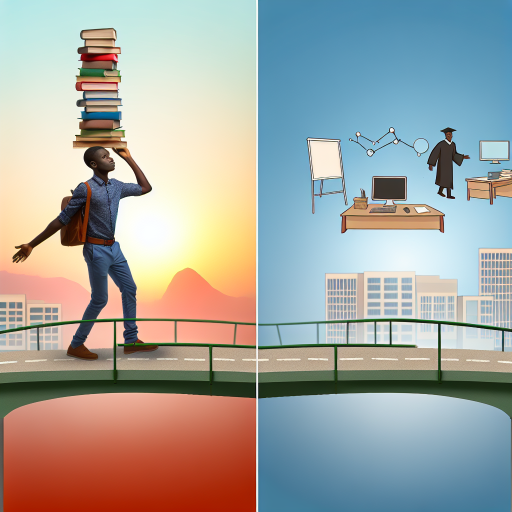

Skills acquisition is vital in achieving your financial goals.

Skills empower you to make informed decisions about investments and savings.

They also help you navigate the complexities of financial markets.

Ultimately, having the right skills enables you to maximize your earning potential.

This leads to greater financial security and independence.

This blog will explore crucial skills for supercharging your financial growth.

First, we will discuss financial literacy.

Understanding financial concepts will help you manage your money wisely.

Next, we will highlight investment skills.

Knowing how to invest can significantly increase your wealth over time.

Additionally, we will cover budgeting skills.

Creating a budget ensures you spend within your means and save effectively.

We will also delve into negotiation skills.

Mastering negotiation can lead to better salaries and deals.

Lastly, we will emphasize the importance of networking.

Building strong relationships can open doors to new opportunities.

Together, these skills form a solid foundation for financial success.

In this fast-paced world, honing these skills is more important than ever.

Financial growth doesn’t happen by chance; it takes dedication and effort.

By actively developing these essential skills, you can position yourself for lasting financial prosperity.

Stay tuned as we unpack each skill in detail.

Let’s embark on the journey to supercharge your financial growth!

Understanding Financial Literacy

Financial literacy has become a crucial skill in today’s fast-paced economy.

It refers to the ability to understand and effectively use various financial skills.

People with strong financial literacy skills are better equipped to make informed financial decisions.

Definition of Financial Literacy and Its Components

Financial literacy encompasses various components that form the foundation for sound financial management.

Here are the key elements:

- Budgeting: The process of creating a plan to manage your income and expenses.

- Saving: The act of setting aside a portion of your income for future needs.

- Investing: Allocating money into financial schemes to generate income or profit.

- Debt Management: Strategies for handling loans and credit efficiently.

- Understanding Financial Products: Knowledge about various options like insurance, loans, and retirement plans.

To grasp financial literacy fully, individuals should explore and understand these components.

Mastering them leads to improved financial health and security.

The Role of Financial Literacy in Making Informed Decisions

Financial literacy plays a vital role in decision-making.

Educated individuals can navigate financial landscapes effectively, leading to better outcomes.

Here are some key reasons why financial literacy is essential:

- Empowered Decision-Making: Informed individuals can make confident choices regarding spending, saving, and investing.

- Risk Management: Understanding various financial products helps in assessing risk and making informed investments.

- Avoiding Financial Pitfalls: Knowledge can protect against scams and poor financial choices.

- Long-Term Planning: Financial literacy enables effective retirement planning and wealth accumulation.

- Increased Financial Security: Making informed decisions leads to better financial outcomes and stability.

Individuals who prioritize financial literacy tend to experience greater financial security.

This security stems from informed choices that prevent debt accumulation and encourage savings.

Tips for Improving Your Financial Literacy

Enhancing financial literacy often begins with a willingness to learn.

Fortunately, many resources are available to help you elevate your understanding.

Below are effective ways to improve your financial literacy:

Read Books

Explore finance-related books that cover basics to advanced concepts.

Recommended titles include:

- “Rich Dad Poor Dad” by Robert Kiyosaki

- “The Total Money Makeover” by Dave Ramsey

- “The Intelligent Investor” by Benjamin Graham

Attend Workshops

Look for local or online workshops focusing on finance.

Many organizations offer events that help improve your knowledge.

Online Courses

Enroll in online courses on platforms like Coursera or Udemy.

Many free and low-cost courses cover a range of topics.

Personalized Financial Consulting – Tailored for You

Get a custom financial plan made just for you in 1-3 days. Clear strategies, actionable steps, and unlimited revisions.

Get StartedFollow Financial Experts

Engage with financial experts on social media.

Their insights can provide valuable tips and timely information.

Join Financial Literacy Organizations

Various non-profits promote financial education.

They often host events or distribute resources.

Improving your financial literacy empowers you to make better decisions.

As you explore these resources, remember that continuous learning is essential.

The more you know, the better equipped you’ll be to face financial challenges to make better decisions.

As you explore these resources, remember that continuous learning is essential.

The more you know, the better equipped you’ll be to face financial challenges.

Understanding financial literacy is fundamental to achieving financial growth.

It provides the knowledge required to make informed decisions.

Embrace the components of financial literacy, such as budgeting and investing.

Develop a habit of improving your knowledge through reading and courses.

By committing to financial education, you position yourself for a more secure financial future.

Budgeting and Money Management

Understanding Budgeting and Its Importance

Budgeting is the process of creating a plan to manage your income and expenses.

It allows you to track where your money goes each month.

This skill is essential for achieving financial stability and success.

Effective budgeting helps you identify and prioritize your financial goals.

It enables you to save for emergencies, reduce debt, and invest for the future.

Without a budget, you risk overspending and falling into financial difficulties.

In today’s fast-paced world, where expenses can quickly escalate, having a budget is non-negotiable.

It provides a clear roadmap for making informed financial decisions.

Ultimately, a budget helps you live within your means while working towards your financial aspirations.

Step-by-Step Approach to Create and Maintain a Budget

Gather Financial Information

Begin by collecting all financial data.

This includes pay stubs, bank statements, and bills.

Knowing your total income and expenses is the foundation of your budget.

Identify Income Sources

List all your income sources, such as salaries, freelancing, or investments.

Include any side hustles or passive income streams.

Add these amounts to determine your total monthly income.

List Fixed and Variable Expenses

Identify your fixed expenses.

These are costs that remain constant each month.

Examples include rent, mortgage, and insurance premiums.

Next, list variable expenses, which can fluctuate.

Examples include groceries, entertainment, and dining out.

Set Financial Goals

Define your short-term and long-term financial goals.

Short-term goals might include saving for a vacation or paying off credit card debt.

Long-term goals could be buying a house or funding retirement.

Create Your Budget

Now that you have all the information, create a budget.

Deduct your total expenses from your total income.

Ensure your expenses do not exceed your income.

If they do, you’ll need to make adjustments.

Monitor Your Spending

Regularly track your spending to ensure you stay within your budget.

Use spreadsheets, pen and paper, or budgeting apps.

Monitoring your spending helps you identify areas for improvement.

Review and Adjust Your Budget

At the end of each month, review your budget.

Analyze any discrepancies between your planned and actual spending.

Adjust your budget as needed based on changing circumstances or goals.

Unlock Your Path to Financial Freedom

Personalized savings and investment strategies tailored to your financial goals. Let's help you take control of your future with a plan designed just for you.

Get StartedTools and Apps to Assist in Effective Budgeting

Using budgeting tools can streamline your financial planning process.

Many apps and tools are available to help you budget effectively.

Here are some popular options:

Mint

Mint is a free budgeting app that aggregates all your accounts.

It tracks your spending and categorizes expenses automatically.

You can set budgets for individual categories, making it easy to stay on track.

YNAB (You Need a Budget)

YNAB is a subscription-based budgeting tool emphasizing proactive financial management.

It encourages users to assign every dollar a job.

This app focuses on budget discipline and future planning.

EveryDollar

EveryDollar offers a simple, user-friendly budgeting experience.

The app allows you to create a monthly budget in just a few minutes.

It also includes a feature for tracking expenses to ensure you stick to your budget.

PocketGuard

PocketGuard links to your bank accounts and tracks your spending.

It shows how much “safe to spend” money you have left after bills and goals.

This app simplifies budgeting while providing insights into your financial health.

GoodBudget

GoodBudget utilizes the envelope budgeting method, where you allocate money to different categories.

This app allows you to set savings goals and track expenses on the go.

It’s a great option for those who enjoy the envelope system.

Mastering budgeting and money management is vital for financial growth.

Adopting a budgeting system empowers you to take control of your finances.

Make conscious choices about your spending and saving habits.

With a clear budget, you can achieve your financial goals and ensure a secure future.

Utilize tools and apps to simplify this process.

Start today to supercharge your financial growth.

Read: Video Editing: A Must-Have Skill

Investment Knowledge

Investment knowledge is crucial for financial growth.

Understanding various investment vehicles can empower you to make informed decisions.

Here, we’ll explore different types of investments, the importance of risk assessment, diversification, and effective strategies for beginning your investment journey.

Different Investment Vehicles

There are several types of investment vehicles.

Each serves unique purposes and comes with different risk levels.

Below are the most common investment types you should consider:

- Stocks: Buying stocks means you purchase shares of a company.

Stocks can yield high returns, but they are volatile.

Understanding the stock market is essential before investing. - Bonds: Bonds are loans that you give to companies or governments.

They pay interest over time and are generally considered safer than stocks.

However, the returns can be lower compared to stocks. - Mutual Funds: Mutual funds pool money from various investors to buy diversified assets.

They are managed by professionals and can be an easy way to start investing. - Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade like stocks.

They often have lower fees and provide easy diversification. - Real Estate: Investing in real estate involves purchasing property.

This can generate rental income or capital appreciation.

However, it requires significant capital and market research. - Cryptocurrencies: Digital currencies like Bitcoin or Ethereum offer high-risk, high-reward opportunities.

They can be highly volatile and require thorough understanding.

Significance of Risk Assessment and Diversification

Risk assessment is a vital aspect of investing.

It involves evaluating the potential risks associated with each investment.

Understanding your risk tolerance helps you make educated choices.

- Identify Your Risk Tolerance: Assess how much risk you are willing to take.

This depends on your financial goals, age, and investment timeline. - Conduct Regular Assessments: Financial markets fluctuate.

Regularly review your portfolio to ensure it aligns with your risk tolerance. - Focus on Asset Allocation: Proper asset allocation spreads your investments across various asset classes.

This reduces the risk associated with any single investment type.

Diversification is also critical in minimizing risks.

By holding a mix of different investments, you can smooth out potential losses.

Consider these strategies to diversify your investments:

- Invest Across Different Asset Classes: Mix stocks, bonds, real estate, and other assets.

This protects your portfolio in changing market conditions. - Include Domestic and International Investments: Investigate options beyond your home country.

This broadens exposure and can enhance potential returns. - Vary Underlying Sectors: Invest in different sectors like technology, healthcare, and finance to spread risk.

Strategies for Starting with Investments on a Limited Budget

No matter your financial situation, investing is possible.

Here are some strategies you can implement:

Take Control of Your Debt Today

Struggling with debt? Get personalized strategies to pay off your debts, negotiate with creditors, and rebuild your credit. Your path to financial freedom starts here.

Get Help- Start Small: Begin with a small amount of money.

Many platforms allow you to invest with as little as $5 or $10. - Use Dollar-Cost Averaging: Regularly invest a fixed amount of money over time.

This strategy reduces the impact of market volatility. - Take Advantage of Tax-Advantaged Accounts: Utilize retirement accounts like IRAs or 401(k)s.

They offer tax benefits and can boost your long-term savings. - Consider Robo-Advisors: Robo-advisors can automate investing for you based on your risk tolerance and goals.

They often come with low fees. - Stay Informed: Keep learning about investment opportunities.

Knowledge can help you make smarter choices with your limited funds. - Participate in Employer Matching Programs: If your employer offers matching contributions to retirement plans, take full advantage.

This is essentially free money.

Investing may seem daunting at first, especially with a limited budget.

However, starting small and gradually building your portfolio is an effective strategy.

Knowledge is empowering, and the more you learn, the better your investment decisions will be.

Having investment knowledge is essential for financial growth.

Understanding various investment vehicles, assessing risk, and implementing diversification strategies can significantly impact your financial future.

Furthermore, even if you have a limited budget, starting your investment journey is achievable.

The key lies in taking that first step and continually learning.

With dedication and the right strategies, you can supercharge your financial growth.

Read: Nigerian Guide to Adobe Suite

Negotiation Skills

Importance of Negotiation in Various Financial Situations

Negotiation is a critical skill that can significantly impact your financial growth.

It affects various financial situations, including salary discussions, contract agreements, and pricing strategies.

Strong negotiation skills can help you secure favorable terms and conditions.

By honing this skill, you can maximize your financial gains across several scenarios.

In salary negotiations, your ability to advocate for yourself is crucial.

Research shows that effective negotiators often earn significantly more than their peers.

They understand the market value of their roles and use this knowledge to negotiate better compensation.

Additionally, they articulate their worth clearly and confidently, making a compelling case for their desired salary.

Contracts also present opportunities for negotiation.

Whether you are signing a lease, a service agreement, or a business contract, negotiation plays a vital role.

You can discuss payment terms, responsibilities, and deliverables.

Each of these elements directly affects your financial obligations and potential gains.

A favorable contract can lead to significant savings or increased revenues.

Pricing negotiation is particularly relevant in consumer transactions.

Whether purchasing a car, negotiating a service, or shopping for bulk goods, your negotiation skills are essential.

In these scenarios, applying good strategies can lead to lower expenses.

As a result, this enhances your overall financial standing.

Key Tactics and Strategies for Effective Negotiation

To negotiate successfully, you need to employ specific tactics and strategies.

Here are some key methods that can improve your outcomes:

- Do Your Research: Understand the market and know what others are paying.

Gather data supporting your position. - Set Clear Goals: Define your desired outcome before entering negotiations.

Know your limits and what you aim to achieve. - Practice Active Listening: Pay attention to the other party’s needs and concerns.

This fosters rapport and can lead to compromise. - Be Confident: Approach negotiations with confidence.

Your self-assurance can influence how others perceive your worth. - Stay Calm: Emotions can run high during negotiations.

Maintaining composure helps you think clearly and make better decisions. - Use Silence Effectively: Sometimes, pausing can pressure the other party to fill the void.

This can lead to concessions. - Find Common Ground: Look for mutually beneficial outcomes.

Emphasizing shared interests can make it easier to reach agreements. - Be Willing to Walk Away: Knowing when to exit negotiations can strengthen your position.

This willingness often leads to better offers.

Real-World Examples Where Negotiation Has Led to Financial Gain

Real-world examples illustrate the power of negotiation in achieving financial gains.

These stories demonstrate how effective negotiation strategies can lead to notable outcomes.

Salary Negotiation Success

Consider a recent college graduate negotiating their first job offer.

After researching industry salary standards, they found comparable positions pay $10,000 more.

During the interview, the graduate presented their research confidently.

They articulated how their skills matched the company’s needs, leading to a $8,000 raise.

This negotiation set a higher salary precedent for future earnings as well.

Contract Negotiation in Real Estate

A small business owner wanted to lease a new retail space.

They researched the local market and discovered comparable spaces were cheaper.

When meeting with the landlord, the owner confidently presented their findings.

They negotiated a rent reduction of 15% and secured additional perks, like parking spaces for customers.

This financial victory supported better cash flow in the early years of their business.

Car Purchase Negotiation

Buying a car is a common financial scenario for many.

One consumer walked into a dealership armed with online pricing information.

They had also studied the dealer’s invoices and gain an insight into inventory.

During negotiations, they countered the initial offer, advocating for a $2,000 price drop.

They not only saved money but also secured a better financing rate by negotiating terms effectively.

Strengthening your negotiation skills is an invaluable investment in your financial future.

The ability to negotiate effectively can significantly affect your salary, contractual terms, and consumer prices.

By employing the right tactics and drawing inspiration from real-world examples, you can enhance your chances of success in negotiations.

Ultimately, negotiation is about creating win-win situations.

When both parties feel satisfied with the outcome, you build long-lasting relationships.

These relationships can lead to future opportunities and financial gains.

Cultivating these skills will serve you well as you seek to supercharge your financial growth.

Read: Future-Proof Your Tech Skills

Networking Abilities

The Impact of Networking on Financial Opportunities and Career Growth

Networking plays a critical role in enhancing financial growth and professional development.

Establishing connections can lead to job opportunities, partnerships, and valuable knowledge exchanges.

In today’s competitive job market, an extensive network often translates into significant advantages.

Here are some ways networking impacts financial opportunities:

- Job Opportunities: Many jobs are filled through referrals rather than advertisements.

Networking gives access to hidden job markets. - Partnerships: Collaborating with others can lead to new business ventures.

These partnerships often result in increased profits. - Information Sharing: Networking allows you to gather insights about industry trends.

This information can help you make informed decisions. - Mentorship Opportunities: Building relationships with experienced professionals can lead to mentorship.

A mentor can provide guidance to enhance your career path. - Access to Resources: A strong network opens doors to various resources.

These can include funding sources, tools, or platforms that aid business growth.

Overall, the impact of networking on one’s financial trajectory is profound.

It fosters career growth and drives financial success through strategic connections.

Strategies to Build and Maintain a Professional Network

Building and maintaining a professional network involves intentional strategies.

Here are some actionable steps to help you develop a robust network:

- Attend Industry Events: Participate in conferences, seminars, and workshops.

These events provide opportunities to meet like-minded professionals. - Join Online Platforms: Utilize platforms like LinkedIn to connect with industry peers.

Engage in relevant discussions to expand your digital presence. - Volunteer: Offer your skills to non-profits or community organizations.

Volunteering can introduce you to influential individuals in your field. - Follow Up: After meeting someone new, follow up with a thank-you message or an invitation for coffee.

This keeps the relationship fresh and builds rapport. - Participate in Professional Groups: Join associations or groups related to your field.

Being an active member enhances visibility and credibility. - Share Your Expertise: Host webinars or workshops to showcase your knowledge.

Sharing valuable insights attracts others to your network. - Be Authentic: Build genuine connections based on mutual interests.

Authenticity fosters trust and encourages deeper relationships.

Applying these strategies will help you establish and grow your professional network significantly.

The more effort you put into networking, the more opportunities will arise.

How to Leverage Relationships for Mutual Financial Benefits

Once you’ve established a network, leveraging these relationships is crucial.

Here’s how to ensure that networking yields mutual financial benefits:

- Collaboration on Projects: Initiate joint projects that benefit all parties involved.

Combining resources and skills creates win-win situations. - Referrals: Recommend trusted connections to your network.

This can lead to reciprocal referrals, which can be beneficial for all. - Knowledge Exchange: Share insights and ask for advice.

By fostering a culture of sharing, everyone in the network can benefit. - Support Each Other’s Projects: Offer assistance on projects or ventures.

Supporting one another encourages a spirit of collaboration. - Participate in Group Investments: Explore opportunities for group investment ventures.

Collaborating on investments can reduce individual risk while boosting potential returns. - Networking Events: Organize events where connections can introduce each other.

This fosters a sense of community and shared benefits. - Solicit Feedback: Ask for input on ideas or strategies.

This not only improves your approach but shows that you value others’ perspectives.

By leveraging the relationships you build, you can create reciprocal opportunities leading to financial success for everyone involved.

Remember that networking is a two-way street, and nurturing these connections yields significant rewards.

Developing networking abilities is essential for anyone looking to supercharge their financial growth.

Networking directly impacts career growth and financial opportunities.

Implementing strategies to build and maintain connections leads to rewarding relationships.

Ultimately, leveraging these relationships for mutual benefits maximizes the potential of your network.

Invest time in building your professional relationships.

The rewards, both personally and financially, will be well worth the effort.

Entrepreneurial Thinking

Entrepreneurial Thinking and Its Role in Financial Growth

A mindset focused on entrepreneurial thinking can greatly influence your financial growth.

It involves viewing the world through a lens of opportunities rather than obstacles.

This shift in perspective allows you to identify potential in various situations.

Entrepreneurial thinking fosters agility and adaptability in a rapidly changing environment.

With these traits, individuals can create innovative solutions that lead to wealth accumulation.

At its core, entrepreneurial thinking encourages proactive behavior.

Instead of waiting for opportunities to come to you, you actively seek them.

This active pursuit increases your chances of spotting profitable ventures.

Furthermore, this mindset emphasizes the importance of taking calculated risks.

By evaluating potential outcomes, you better understand the rewards and consequences of your decisions.

The role of entrepreneurial thinking in financial growth extends beyond traditional business ownership.

It’s about embedding this approach into your daily life.

Even employees can benefit from entrepreneurial thinking by innovating solutions for their workplaces.

This mindset allows individuals to contribute value, which can lead to career advancements.

Thus, adopting entrepreneurial thinking sets the stage for financial rewards in various contexts.

Key Characteristics of Entrepreneurial Individuals

Many successful entrepreneurs share specific traits.

Understanding these characteristics can help you develop your own entrepreneurial mindset.

Here are three key traits:

- Creativity: Entrepreneurial individuals often possess a unique ability to think outside the box.

They see connections between seemingly unrelated ideas.

Their creativity allows them to develop innovative products or services that meet market needs.

This innovation can lead to financial success by capturing customer attention. - Risk-Taking: Successful entrepreneurs are not afraid to take risks.

They understand that risk is inherent in business and investing.

However, they assess risks through careful analysis.

This calculated approach enables them to make informed decisions.

By taking smart risks, they can open doors to lucrative opportunities. - Resilience: Resilience is key in overcoming setbacks.

The journey of entrepreneurship is often fraught with challenges.

Those who can bounce back from failures have a higher chance of success.

Resilient individuals learn from their mistakes and adjust their strategies.

This adaptability drives continuous improvement and financial growth.

Tips for Cultivating an Entrepreneurial Mindset in Daily Life

Building an entrepreneurial mindset doesn’t require starting a business.

You can foster this way of thinking in various aspects of your life.

Here are some practical tips:

- Embrace Continuous Learning: Read books, take courses, and attend workshops.

Stay updated with industry trends and market changes.

Learning keeps your mind agile and ready for new opportunities. - Network Actively: Surround yourself with like-minded individuals.

Attend networking events and engage in discussions.

Networking connects you to potential collaborators, mentors, and opportunities. - Practice Problem-Solving: Approach daily challenges as opportunities to innovate.

Modify your routine to include brainstorming sessions.

Regularly ask yourself how you can do things differently to achieve better results. - Set Goals: Define clear, achievable goals for yourself.

Take time to reflect on your ambitions and create a roadmap to attain them.

Break larger goals into smaller steps to maintain focus and motivation. - Accept Failure: Understand that failure is part of the journey.

Instead of fearing failure, view it as a learning experience.

Analyze what went wrong and re-adjust your approach for success. - Stay Open to Opportunities: Keep an eye out for new ventures, projects, or investments.

Sometimes, the best opportunities come unexpectedly.

Being open-minded enables you to capitalize on these chances. - Foster Creativity: Engage in creative activities outside of your comfort zone.

Consider taking up art, writing, or music.

These activities stimulate creative thinking, which can be applied to your financial decisions. - Develop a Risk Assessment Strategy: Before taking risks, create a strategy to assess them effectively.

Outline potential risks, analyze their impacts, and develop mitigation plans.

This approach helps you make informed decisions.

Adopting an entrepreneurial mindset empowers you to control your financial future.

Embrace key strategies and characteristics to accelerate growth.

Whether experienced or a beginner, entrepreneurial thinking equips you with the tools for success.

Explore your potential!

Continuous Learning and Adaptability

Importance of Continuous Learning in Finance

In today’s fast-paced financial world, change is the only constant.

Financial markets evolve due to technology advancements, regulatory changes, and shifting consumer behaviors.

Staying updated with these trends is vital for your financial growth.

Continuous learning empowers you to make informed decisions.

Understanding new investment opportunities can significantly influence your financial strategies.

Here are key reasons why staying informed matters:

- It enhances your knowledge base and skills.

- It helps you identify market trends early.

- It keeps you competitive in a dynamic job market.

- It provides insight into potential risks and rewards.

- It shapes your overall strategy for financial growth.

Strategies for Ongoing Education

Investing in your education is one of the best financial moves.

Various resources are available to help you stay updated.

Here are effective strategies for ongoing education in finance:

- Online Courses: Platforms like Coursera and Udemy offer finance courses from experts.

You can learn at your own pace and on your schedule. - Workshops and Seminars: Attend local and online workshops.

These events allow for networking and learning from experienced professionals. - Reading Financial Publications: Subscribing to financial magazines like The Economist or Financial Times keeps you informed on current events and trends.

- Podcasts and Webinars: Listen to finance-focused podcasts.

You can access expert discussions while commuting or exercising. - Joining Professional Associations: Organizations like CFA Institute provide resources, networking, and educational opportunities.

Developing an Adaptable Mindset

Navigating financial uncertainties requires flexibility and resilience.

An adaptable mindset helps you cope with unexpected changes in the market.

Here are practical steps to develop this essential trait:

- Embrace Change: Acknowledge that change is inevitable.

Being open to new ideas and perspectives fosters adaptability. - Set Goals and Review Regularly: Establish short-term and long-term goals.

Regularly review these goals to adjust them as needed. - Remain Curious: Cultivating curiosity leads to continuous learning.

Seek to understand various financial aspects and market dynamics. - Learn from Mistakes: View failures as learning experiences.

Analyze what went wrong and how you can improve. - Surround Yourself with Diverse Thinkers: Engage with people from various backgrounds.

Diverse perspectives can improve your decision-making process.

The Role of Technology in Learning

Technology revolutionizes how we learn about finances.

Online resources provide access to a wealth of information at your fingertips.

Consider these technological advancements:

- Mobile Financial Apps: Use financial apps for budgeting and investment tracking.

These tools keep your financial goals in check. - Social Media: Follow financial influencers and experts on platforms like Twitter and LinkedIn.

They share valuable insights and resources. - Web Tutorials and Videos: Platforms like YouTube provide tutorials on complex financial topics.

Visual learning enhances understanding and retention. - Online Forums and Communities: Engage in online forums like Reddit or Quora.

These communities often discuss valuable financial strategies and tips. - Virtual Reality Learning: Some platforms offer immersive learning experiences.

Virtual reality can simulate real-world financial scenarios for practice.

Maintaining a Lifelong Learning Mindset

To truly supercharge your financial growth, cultivate a lifelong learning mindset.

This attitude not only enhances your skill set but also fosters resilience.

Here are steps to maintain this mindset:

- Commit to Self-Improvement: Dedicate time weekly to learn something new.

This could be through reading, courses, or networking. - Practice Reflection: After learning, reflect on how you can apply this knowledge.

This practice reinforces new concepts and skills. - Network with Like-Minded Individuals: Surround yourself with learners.

Sharing insights motivates you and opens new learning avenues. - Challenge Your Assumptions: Regularly assess your beliefs about finance.

Challenging your assumptions can lead to greater understanding. - Stay Patient: Learning is a journey, not a sprint.

Be patient with your growth and remain committed to progress.

Continuous learning and adaptability are vital for financial growth.

By investing in your education and developing an adaptable mindset, you empower yourself to face uncertainties confidently.

Embrace opportunities to learn, and remain flexible in response to change.

This combination will significantly benefit your financial journey.

Conclusion

In this post, we uncovered essential skills to boost your financial growth.

First, we discussed budgeting.

Mastering this skill enables you to track your income and expenses efficiently.

Next, we explored investing basics.

Understanding investment vehicles helps you make informed decisions that align with your goals.

Then, we examined financial literacy.

Having a solid grasp of financial terms empowers you to navigate markets confidently.

Additionally, we highlighted the importance of risk management.

Learning to assess and mitigate risks protects your investments over time.

We also reviewed negotiation skills.

Being an effective negotiator can lead to better financial deals in various situations.

Lastly, we talked about networking.

Building connections opens doors to opportunities that can enhance your financial journey.

Now, it’s time to take action.

Start by identifying which skills you want to develop first.

Set realistic goals for learning and practicing these skills regularly.

Take courses, read books, or seek mentorships.

Remember, investing in your financial skills pays off in the long run.

The more you learn, the more empowered you become.

Embrace a proactive mindset toward your financial education.

This commitment will lead you to sustainable growth and success.

As you enhance your skills, envision the rewarding financial future that awaits you.

Your dedication today shapes your tomorrow.